Social Security

What VA Form Do You Need to Fill Out to Apply for Educational Benefits for Dependents?

Many veterans and active service members wish to support their families in accessing education through VA-provided benefits. To ensure dependents receive these benefits, veterans or their family members need to complete specific VA forms.

What Is VA Educational Assistance for Dependents?

The Department of Veterans Affairs (VA) offers educational benefits to the dependents of veterans through several programs, including the Survivors’ and Dependents’ Educational Assistance (DEA) Program and the Post-9/11 GI Bill® transfer option. These programs provide financial assistance to eligible dependents, which can cover tuition, fees, housing, and other education-related expenses.

Key Programs for Dependents

- DEA Program (Chapter 35): Designed for dependents of veterans who are disabled or deceased due to service-related issues.

- Transfer of Post-9/11 GI Bill® Benefits: Allows eligible service members to transfer unused educational benefits to their spouse or children.

Which VA Form Should You Use to Apply?

The primary VA form used to apply for educational benefits for dependents is VA Form 22-5490, officially titled the Dependents’ Application for VA Education Benefits. This form is used for the DEA program and other applicable benefits, helping dependents apply for financial aid to pursue educational goals.

VA Form 22-5490 Details

- Purpose: VA Form 22-5490 allows the dependent of an eligible veteran to apply for education benefits, including DEA.

- Who Uses It: This form is for dependents such as spouses, children, and surviving family members of veterans.

- How to Submit: Form 22-5490 can be submitted online through the VA’s eBenefits portal or completed as a paper application and mailed.

Eligibility Criteria for Educational Benefits

Before completing the form, it is essential to verify eligibility. Eligibility depends on factors such as the veteran’s service record and the relationship between the applicant and the veteran.

Basic Eligibility for the DEA Program (Chapter 35)

- Spouses and Children of veterans who have a permanent and total disability due to a service-connected condition.

- Surviving Family Members of veterans who died due to a service-connected disability.

- Dependents of veterans who are listed as Missing in Action (MIA) or prisoners of war.

Eligibility for Post-9/11 GI Bill® Transfer

To transfer Post-9/11 GI Bill® benefits to dependents, service members must meet additional requirements:

- Minimum Service Requirements: Generally, the service member must have at least six years of active service to be eligible to transfer benefits.

- Continued Service Agreement: They must also commit to additional service as determined by the Department of Defense.

How to Complete VA Form 22-5490?

Completing VA Form 22-5490 is a straightforward process, but it is important to be accurate with the information provided to avoid delays.

- Basic Information: Begin by filling out the applicant’s full name, Social Security number, and contact information.

- Veteran’s Information: Include the veteran’s full name, Social Security number, and details regarding service history.

- Type of Benefit: Indicate which type of benefit you are applying for, usually the DEA program for spouses or children.

- Education Information: Describe the educational institution and the program in which the dependent plans to enroll.

The completed form can be submitted online through eBenefits or printed and mailed to the VA regional office.

How Long Does It Take to Process?

After submitting the application, the VA typically takes between 30 to 45 days to process the form and determine eligibility. If additional information is required, the VA may contact the applicant, which could extend processing time.

What to Do If Processing Is Delayed?

If processing exceeds 45 days, contact your regional VA office for an update. It can be helpful to track the status of your application online if you submitted it via eBenefits.

Additional Forms That May Be Required

In some cases, additional documentation or forms may be required based on specific circumstances:

- VA Form 22-5495 – Dependents’ Request for Change of Program or Place of Training: Use this form if a dependent needs to update their educational program or institution after initially being approved for benefits.

- VA Form 21-686c – Declaration of Status of Dependents: This form may be necessary to verify the dependent relationship with the veteran.

Important Deadlines and Time Limits

Each educational benefit program has specific timelines and deadlines:

- DEA Program (Chapter 35): Generally, eligible dependents have 10 years from the date of eligibility to use these benefits, though some cases may extend this period.

- Post-9/11 GI Bill®: Benefits typically expire 15 years after the last period of active duty for the veteran. For transferred benefits, eligible dependents should confirm any expiration with the VA or Department of Defense.

Tips for a Successful Application

- Ensure Eligibility: Double-check eligibility requirements before submitting the application.

- Accurate Information: Any errors or omissions in the application can cause delays.

- Track Application Status: If you submit online, use the VA’s eBenefits portal to monitor your application’s progress.

- Prepare Supporting Documents: Have documents like proof of relationship, birth certificates, or marriage certificates ready if the VA requests additional verification.

Conclusion

VA Form 22-5490 is essential for dependents seeking educational benefits under programs like DEA. Understanding the eligibility requirements, completing the form accurately, and meeting deadlines are all crucial to ensuring a smooth application process. By using the resources available through the VA and staying informed on requirements, dependents can effectively access the financial support they need to pursue education.

FAQs

Can I apply for both DEA benefits and the Post-9/11 GI Bill® benefits?

No, dependents must choose between the DEA program and Post-9/11 GI Bill® benefits if eligible for both. You cannot receive both benefits simultaneously.

How long does the VA take to process VA Form 22-5490?

The VA typically processes VA Form 22-5490 within 30 to 45 days. Applicants can track the progress online through eBenefits if submitted digitally.

What happens if I need to change my school or program?

If you need to change your school or program, submit VA Form 22-5495 to request a change.

Can benefits be used for online education?

Yes, both DEA and Post-9/11 GI Bill® benefits can be used for accredited online programs that meet VA standards.

Are there any age limits for children using DEA benefits?

Yes, children using DEA benefits generally must be between 18 and 26 years of age to qualify.

Social Security

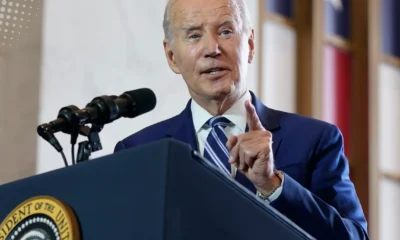

Taxes and Social Security Trump Economic Plan in Policy Debates

Economic policies, including taxes and Social Security, have become focal points in shaping the nation’s future economic strategies. On 15 November, key discussions emerged among policymakers regarding how taxes and Social Security impact long-term economic stability. These debates highlight the challenges of balancing fiscal responsibility with providing support to millions of Americans who rely on Social Security benefits.

Why Are Taxes and Social Security Key in Economic Planning?

Taxes and Social Security are essential pillars of the U.S. economy. Taxes fund public services and infrastructure, while Social Security provides income security to retirees, disabled individuals, and surviving family members. Recent proposals emphasize the need for reforms in these areas to address challenges such as funding shortfalls and increasing income inequality.

What Are the Current Issues with Social Security?

1. Trust Fund Solvency

The Social Security Trust Fund faces potential depletion by 2034, according to the Social Security Administration (SSA). If this happens, beneficiaries could see a reduction in payouts of up to 20%.

2. Inadequate Benefits

The average monthly Social Security benefit for retirees is $1,800, which struggles to keep pace with rising living costs, especially healthcare and housing.

3. Demographic Shifts

An aging population and declining birth rates have placed additional pressure on the Social Security system. There are fewer workers paying into the system compared to the growing number of beneficiaries.

How Do Taxes Influence Economic Plans?

Taxes determine how the government funds essential services and programs, including Social Security. Discussions on tax policy often center around:

- Fairness: Ensuring high-income earners contribute a larger share.

- Economic Growth: Avoiding tax policies that may discourage investment or reduce consumer spending.

- Deficit Reduction: Balancing tax revenues with government spending to avoid national debt escalation.

What Proposals Are on the Table?

1. Raising the Social Security Payroll Tax Cap

Currently, only earnings up to $160,200 are subject to Social Security payroll taxes. Proposals suggest taxing income above $250,000, which could extend the program’s solvency by decades.

2. Introducing New Tax Brackets for High Earners

Some lawmakers propose additional tax brackets for individuals earning over $1 million annually. This measure aims to reduce income inequality while increasing federal revenue.

3. Implementing a Financial Transactions Tax

A small tax on stock trades and other financial transactions could generate significant revenue to support Social Security and other programs.

How Does Public Opinion Shape the Debate?

Surveys indicate widespread support for preserving and strengthening Social Security. According to a recent Pew Research Center poll:

- 70% of Americans support raising taxes on high-income earners to fund Social Security.

- 65% of respondents prioritize maintaining or increasing Social Security benefits over deficit reduction.

This public sentiment pressures lawmakers to prioritize reforms that protect Social Security while addressing concerns about tax fairness.

How Do Experts Weigh In?

Economists

Economists warn that delaying reforms could worsen funding gaps. They advocate for proactive measures, such as raising the retirement age or adjusting tax policies, to ensure long-term stability.

Advocacy Groups

Organizations like AARP and the Center on Budget and Policy Priorities emphasize the importance of protecting low-income beneficiaries while securing the program’s future through equitable tax reforms.

What Are the Potential Risks of Inaction?

Failure to address Social Security and tax reforms could lead to:

- Benefit Cuts: Without intervention, beneficiaries may face a reduction in payments by up to 20% starting in 2034.

- Increased Deficits: A lack of revenue growth could exacerbate national debt levels.

- Economic Inequality: Current policies may widen the gap between high-income earners and low-income families.

What Can Be Done to Balance Taxes, Social Security, and Economic Growth?

Short-Term Solutions

- Raising the payroll tax cap to increase revenue.

- Introducing targeted tax increases on high-income earners.

Long-Term Strategies

- Reforming benefit formulas to prioritize low-income beneficiaries.

- Encouraging policies that boost workforce participation to increase tax contributions.

Taxes and Social Security remain central to economic planning in the United States. Policymakers face the challenge of balancing fiscal responsibility with ensuring financial stability for millions of Americans. As debates continue, it is clear that bold and equitable reforms are necessary to secure the future of Social Security and maintain economic growth.

What Can Be Done to Balance Taxes, Social Security, and Economic Growth?

Short-Term Solutions

- Raising the payroll tax cap to increase revenue.

- Introducing targeted tax increases on high-income earners.

Long-Term Strategies

- Reforming benefit formulas to prioritize low-income beneficiaries.

- Encouraging policies that boost workforce participation to increase tax contributions.

Taxes and Social Security remain central to economic planning in the United States. Policymakers face the challenge of balancing fiscal responsibility with ensuring financial stability for millions of Americans. As debates continue, it is clear that bold and equitable reforms are necessary to secure the future of Social Security and maintain economic growth.

FAQs

Will taxes increase for middle-class Americans under proposed reforms?

Most proposals focus on raising taxes for individuals earning over $250,000 annually. Middle-class taxpayers are unlikely to see significant changes.

How will Social Security reforms impact retirees?

Proposed reforms aim to increase benefits and ensure timely payouts, offering greater financial security to retirees.

What happens if the Social Security Trust Fund runs out?

If the trust fund depletes, benefits would be reduced to match incoming revenue, leading to significant cuts for beneficiaries.

Social Security

Kamala Harris’ $25,000 Down Payment Assistance Plan

As housing prices continue to surge, homeownership remains a distant dream for many Americans, particularly for first-time buyers. In response, Vice President Kamala Harris has proposed an ambitious plan to provide up to $25,000 in federal down payment assistance. This initiative, aimed at helping millions of first-time homebuyers, could reshape the housing market and make homeownership more accessible.

What Is Kamala Harris’ $25,000 Down Payment Assistance Plan?

The $25,000 Down Payment Assistance Plan is part of a larger effort to address the growing housing affordability crisis in the United States. It offers first-time homebuyers a one-time financial grant to help cover the often-prohibitive costs of a down payment, which is a significant barrier to homeownership for many low- and moderate-income families.

The plan stems from Harris’ broader economic proposal, which focuses on providing financial relief to those struggling with rising housing costs. By helping Americans overcome the hurdle of down payment requirements, this initiative aims to create a more inclusive pathway to homeownership, particularly for renters who have a consistent payment history.

Who Qualifies for the $25,000 Homebuyer Assistance Program?

To be eligible for the $25,000 homebuyer assistance program, applicants must meet specific criteria. The plan is targeted toward first-time homebuyers, and while some details are still being finalized, the key qualifications are expected to include:

- First-Time Homebuyer Status: Applicants must not have previously owned a home.

- Rental History: Potential homeowners must have paid their rent on time for at least two consecutive years.

- Income Requirements: The program will likely cater to low- and moderate-income families, although exact income limits have not yet been confirmed.

- U.S. Citizenship: Only U.S. citizens or permanent residents will be eligible for the grant.

- Geographic Focus: Specific eligibility requirements based on location may be introduced, depending on local housing market conditions.

These criteria are designed to help those who have demonstrated financial responsibility as renters but have been unable to save enough for a down payment.

How Will the $25,000 Assistance Be Distributed?

The $25,000 down payment assistance is expected to be administered by the federal government and distributed in a straightforward process. Here’s how the disbursement process is expected to work:

- Application Process: Eligible homebuyers will need to apply through a designated platform, likely a government-run website.

- Verification: Applicants will need to submit proof of income, rental history, and other documents verifying their eligibility.

- Disbursement: Once approved, the $25,000 will be directly applied to the down payment for the purchase of the new home. The funds may be disbursed through tax credits or direct grants.

It is important to note that the exact process for applying and receiving funds will be clarified once the program is officially launched.

What Are the Goals of the $25,000 Down Payment Assistance Plan?

Kamala Harris’ plan aims to address several critical issues in the U.S. housing market. Here are the main objectives:

- Increase Homeownership: By providing down payment assistance, the program aims to make homeownership more accessible to first-time buyers, particularly low-income families and marginalized communities.

- Address Housing Affordability: Rising home prices have made it difficult for many families to save for a down payment. This initiative is designed to reduce the financial burden of homeownership.

- Promote Economic Stability: Homeownership is one of the primary ways families build wealth in the U.S. By helping more people buy homes, the program aims to foster long-term financial stability.

The proposal also includes tax credits for builders to encourage the construction of more homes, which could help alleviate the ongoing housing shortage.

How Will This Program Affect the Housing Market?

The impact on the housing market is expected to be significant. If the plan is successfully implemented, it could:

- Boost Demand for Homes: With more people able to afford a down payment, the demand for homes will likely increase, particularly in areas with high rental populations.

- Increase Housing Supply: To address supply constraints, Harris has proposed incentives for homebuilders to construct 3 million new housing units. These tax credits could help balance the increased demand and prevent prices from skyrocketing.

- Help Marginalized Communities: By expanding homeownership opportunities, the plan aims to reduce economic disparities, particularly for racial minorities and low-income households.

However, some experts have raised concerns that increasing demand without sufficient supply could lead to higher home prices, further exacerbating the affordability crisis. Ensuring that the program is coupled with robust construction efforts will be critical to its success.

What Are the Potential Challenges of the $25,000 Assistance Plan?

While the proposal has received widespread support, it also faces several challenges that need to be addressed:

- Supply Constraints: Critics argue that without increasing the supply of affordable housing, providing down payment assistance could inflate home prices even further.

- Funding Concerns: The estimated cost of the program is around $200 billion over four years, which may face opposition in Congress. Funding the initiative will require careful balancing of economic priorities.

- Logistical Challenges: The program’s success will depend on its implementation. Ensuring that the funds are distributed efficiently and that the application process is transparent will be key to achieving its goals.

Key Details of the $25,000 Down Payment Assistance Plan

| Details | Information |

|---|---|

| Program Name | $25,000 Down Payment Assistance Plan |

| Proposed By | Vice President Kamala Harris |

| Amount | $25,000 (one-time payment) |

| Eligibility Criteria | First-time homebuyers, consistent rental history, low- to moderate-income households |

| Geographic Focus | Nationwide (may include geographic considerations) |

| Income Limits | Not yet confirmed |

| Administration | Federal Government |

| Expected Impact | Increase homeownership, reduce down payment burden, promote economic stability |

Conclusion

The $25,000 Down Payment Assistance Plan has the potential to be a game-changer for millions of Americans, particularly those who have been unable to save for a down payment. By making homeownership more accessible, this initiative could have far-reaching benefits for families and communities across the country.

While there are still challenges to be addressed, including supply shortages and funding concerns, the proposal represents a significant step forward in tackling the housing affordability crisis. For first-time homebuyers, this plan could be the key to unlocking the door to their own home.

FAQs

How can I apply for the $25,000 homebuyer grant?

Once the program is officially launched, eligible homebuyers will likely apply online through a government website. You will need to submit proof of income, rental history, and other documents to verify eligibility. More details on the application process will be available when the program is officially announced.

Is the $25,000 down payment assistance a loan or a grant?

The $25,000 assistance is a one-time grant, not a loan. This means recipients do not need to repay the amount, as it is meant to help cover the down payment on a new home.

What types of homes can I buy with the $25,000 grant?

The assistance is designed to help first-time homebuyers purchase primary residences. The specific types of homes eligible for the program (e.g., single-family homes, condos, etc.) will likely depend on the final details of the initiative.

How will the $25,000 be distributed?

Once an applicant is approved, the $25,000 will be applied directly toward the down payment of the home. It is expected to be distributed through either direct grants or tax credits. More details will be released as the program is finalized.

When will the $25,000 down payment assistance be available?

As of now, the program is still in the proposal phase. If approved, it is expected to roll out sometime during or after 2024. Homebuyers should follow updates from official government sources to know when the application process begins.

How will this program be funded?

The $25,000 down payment assistance plan is estimated to cost $200 billion over four years. This will require congressional approval, and discussions are ongoing regarding how to fund the initiative within the broader federal budget.

Is this program similar to past homebuyer assistance initiatives?

Yes, this program is similar in intent to past initiatives, such as the $8,000 first-time homebuyer credit introduced in 2008. However, the current proposal is more targeted, offering larger down payment assistance and focusing on consistent renters. It also includes measures to stimulate housing supply, which were not part of previous programs.

Can immigrants or undocumented residents apply for the $25,000 assistance?

Currently, only U.S. citizens and permanent residents are expected to qualify for the assistance. Details on how the program will handle other immigration statuses have not been confirmed yet.

Social Security

FEMA $750 Serious Needs Assistance: Eligibility & Application

As hurricanes and other natural disasters continue to impact communities across the United States, federal assistance programs like the Federal Emergency Management Agency (FEMA) become critical in providing immediate relief. One of the most widely discussed FEMA aid programs in 2024 is the $750 Serious Needs Assistance, a grant designed to help disaster survivors quickly meet essential needs. Misinformation about this grant has spread online, with claims suggesting it is a loan that must be repaid.

What Is FEMA’s $750 Serious Needs Assistance?

FEMA’s $750 Serious Needs Assistance is an up-front grant provided to disaster survivors to help cover essential expenses in the immediate aftermath of a disaster. This program was introduced in 2024 as part of FEMA’s efforts to streamline disaster relief and provide quick financial support to individuals and families affected by hurricanes, tornadoes, and other significant disasters.

The $750 payment is intended to help survivors cover immediate, critical needs, such as:

- Food and water

- Emergency supplies like personal hygiene products and first-aid items

- Fuel for transportation

- Medicine

- Childcare essentials like diapers and baby formula

Is the $750 FEMA Payment a Loan?

No, the $750 Serious Needs Assistance is not a loan. It is a grant, meaning that survivors do not need to repay this money. Misinformation circulating on social media has suggested that this payment is a loan that must be returned, but this is false. FEMA has confirmed that disaster survivors receiving this grant are not required to pay it back unless they receive insurance or other benefits that specifically cover the same expenses.

According to FEMA’s Public Affairs Director Jaclyn Rothenberg, the goal of this assistance is to quickly provide survivors with funds they can use to purchase essential items as they begin to recover from a disaster.

Who Qualifies for the FEMA $750 Grant?

To qualify for the FEMA $750 grant, survivors must meet several basic criteria:

- Citizenship: At least one member of the household must be a U.S. citizen, non-citizen national, or qualified non-citizen.

- Primary Residence: The household must reside in the disaster-affected home for the majority of the year.

- Disaster Declaration: The home must be located in a declared disaster area, and the disaster must have caused damage to the property. FEMA will verify this based on documentation provided by the survivor.

- Identity Confirmation: FEMA requires proof of identity for the primary applicant to ensure that aid is provided to legitimate disaster survivors.

How to Apply for FEMA’s $750 Serious Needs Assistance

Disaster survivors who meet the eligibility criteria can apply for the $750 FEMA payment through the following steps:

- Register with FEMA: Visit the FEMA website or call the FEMA helpline to register for disaster assistance. Survivors can also visit a local Disaster Recovery Center if available.

- Provide Required Documentation: Applicants must submit identification, proof of residency, and any necessary documents to verify the damage caused by the disaster.

- Direct Deposit or Debit Card: Once approved, FEMA will deposit the $750 directly into the survivor’s bank account or issue a prepaid debit card for those without banking access.

How Many People Have Received the $750 Assistance?

Since its introduction in 2024, over 1 million households have received FEMA’s $750 Serious Needs Assistance, with more than $780 million distributed in total. This assistance has provided essential relief to disaster survivors in areas affected by major hurricanes, such as Hurricane Helene and Hurricane Milton, which struck the southern United States in 2024.

Additional Assistance Beyond the $750 Grant

The $750 grant is only the first part of FEMA’s comprehensive assistance program. After receiving this initial payment, disaster survivors may be eligible for additional forms of aid, depending on their circumstances and the severity of the disaster. Some of the other types of assistance available include:

- Temporary Housing: FEMA can provide funds to help survivors cover the cost of temporary lodging while their homes are being repaired or rebuilt.

- Home Repairs: FEMA offers grants to help repair or replace damaged homes, including covering the cost of replacing essential appliances like stoves, refrigerators, and water heaters.

- Medical Expenses: Disaster survivors can receive financial support for medical treatments and prescriptions required as a result of the disaster.

- Funeral Expenses: FEMA may provide assistance to help cover funeral costs for individuals who died as a result of the disaster.

FEMA’s goal is to provide comprehensive support to disaster survivors as they recover from the impact of storms, ensuring they can rebuild their lives.

FEMA’s Efforts to Combat Misinformation

Misinformation about FEMA’s disaster relief programs has been widespread, especially on social media. Former President Donald Trump inaccurately stated during a rally that FEMA was offering only a one-time payment of $750 to people whose homes were destroyed, which he compared unfavorably to foreign aid spending.

FEMA officials, including Administrator Deanne Criswell, have expressed concern that these false claims could discourage disaster survivors from applying for assistance. Criswell emphasized that the $750 payment is just the beginning of the aid available and encouraged everyone affected by a disaster to register for help.

Conclusion

FEMA’s $750 Serious Needs Assistance plays a critical role in providing fast, essential aid to disaster survivors. Contrary to misinformation, this is not a loan, and it represents only the initial phase of FEMA’s broader assistance program. By registering with FEMA and applying for available aid, disaster survivors can access the financial support they need to rebuild their lives.

FAQs

Is the $750 FEMA grant a loan?

No, the $750 Serious Needs Assistance is a grant that does not need to be repaid.

Who qualifies for the $750 FEMA payment?

Disaster survivors who live in a declared disaster area, are U.S. citizens or qualified non-citizens, and have experienced damage to their primary residence are eligible.

How do I apply for the FEMA $750 payment?

Survivors can apply by registering on the FEMA website, calling the FEMA helpline, or visiting a local Disaster Recovery Center.

Can I receive more assistance beyond the $750 grant?

Yes, FEMA offers additional financial assistance for temporary housing, home repairs, medical expenses, and more.

How will I receive the $750 payment?

FEMA will deposit the payment directly into your bank account or provide a prepaid debit card.

-

Stimulus Check3 weeks ago

Stimulus Check3 weeks agoAlaska’s $3284 Stimulus Check: Eligibility, Payment Details & How to Apply

-

Stimulus Check3 weeks ago

Stimulus Check3 weeks agoColorado $1,600 Stimulus Check 2024: Eligibility, Payment Dates & How to Apply

-

SSI3 weeks ago

SSI3 weeks agoSSI Payments 2025: New Benefit Amounts & Eligibility

-

Finance4 weeks ago

Finance4 weeks agoNew Jersey Real Estate Gap Financing Grant Program: Applications Now Open

-

Stimulus Check3 weeks ago

Stimulus Check3 weeks ago2024 $800 Stimulus Check: Eligibility, Payment Dates & How to Claim

-

Stimulus Check4 weeks ago

Stimulus Check4 weeks ago$725 Stimulus Check Under FFESP Program in 2024: Eligibility & Payment Details

-

Stimulus Check4 weeks ago

Stimulus Check4 weeks ago$1000 Stimulus Checks 2024: Eligibility, Payment Dates & How to Apply

-

Social Security4 weeks ago

Social Security4 weeks agoGoodbye to Social Security Check Increase: FED Confirms Low COLA Adjustment for 2025